CUSTOMS

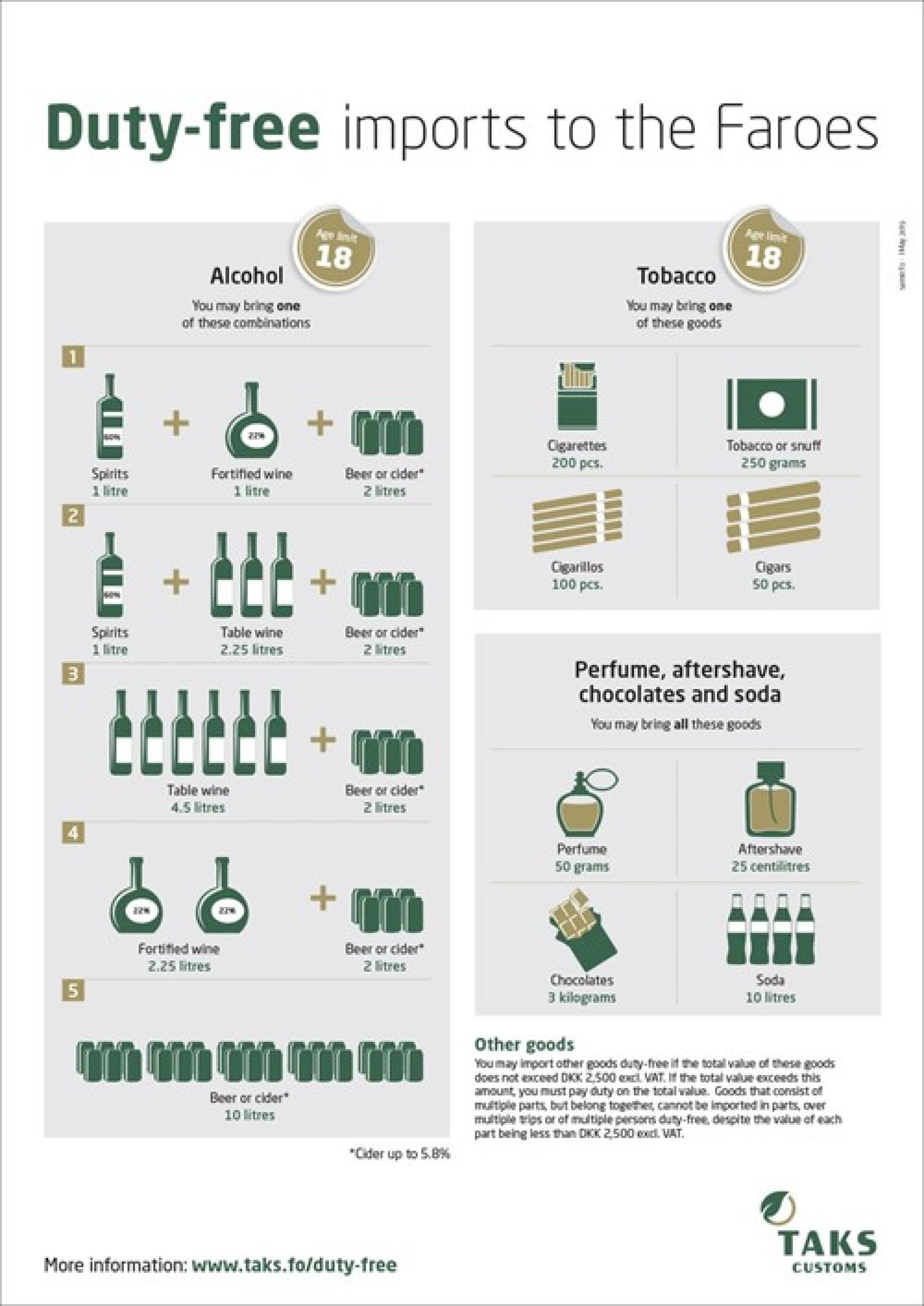

The import of goods to the Faroe Islands can be divided into two groups: duty and tax-free import, and import of other goods.

DUTY AND TAX-FREE

You may import duty and tax-free goods, provided that:

– the goods are for personal use only and not for selling or other purpose of business

– you bring the goods in your own personal luggage, in order that you, upon request, readily can show them to the customs authorities when going through customs

These goods can be imported duty and tax-free, provided that the traveller is 18 years old:

Spirits over 22% vol.alc.: max. 1 litre (up to 60% vol.alc.)

Fortified wine etc. up to 22% vol.alc.: max 1 litre

Beer: max 2 litres

OR

Spirits over 22% vol. alc.: max. 1 litre (up to 60% vol. alc.)

Table wine: max. 2.25 litres

Beer: max. 2 litres

OR

Table wine: Max 4.5 litres

Beer: Max 2 litres

OR

Beer: max. 10 litres

Cigarettes: max. 200 pcs.

OR

Cigarillos: max. 100 pcs.

OR

Cigars: max. 50 pcs.

OR

Tobacco: max. 250 grams

In addition, anyone may import duty and tax-free:

Perfume: max. 50 g.

Eau de toilette: max. 250 ml.

Chocolate products: max. 3 kg.

Soda: max. 10 litres

OTHER GOODS

You may import other types of goods without paying duty and tax, providing the total value of these goods does not exceed DKK. 2.500,-. If the total value exceeds DKK. 2.500,- duty and tax must be paid of the total value.

Goods consisting of multiple parts that form a whole, operate together or are normally sold together, where the total value is determined to exceed DKK 2.500,- are liable to duty and tax. Nor can they be imported in parts, e.g. multiple times or by multiple persons, despite the value of each part being less than DKK 2.500,-.

For more information on customs regulations, consult Taks.